Have you submitted your application for Punjab’s revolutionary interest-free business loan scheme and now find yourself constantly wondering about its status? You’re not alone. Thousands of entrepreneurs across Punjab are eagerly awaiting updates on their applications for the Asaan Karobar Finance Scheme. Knowing how to check Asaan Karobar loan status effectively can save you countless hours of uncertainty and help you plan your business moves accordingly.

The anticipation after submitting a loan application can be overwhelming, especially when your business dreams hang in the balance. Fortunately, the Punjab government has implemented multiple convenient methods to track your application progress, ensuring transparency and keeping applicants informed throughout the process.

With the scheme’s expansion to accommodate 24,000 SMEs in the 2025-26 fiscal year, understanding the status checking process becomes even more crucial for entrepreneurs looking to secure their share of the Rs. 100 billion allocated fund. Let’s explore every method available to track your application and understand what each status means for your business future.

If you’re new to this scheme and haven’t applied yet, first go through our Complete Guide to Asaan Karobar Finance Scheme 2025

Table of Contents

How to Check Asaan Karobar Loan Status

Through Official Portal Login

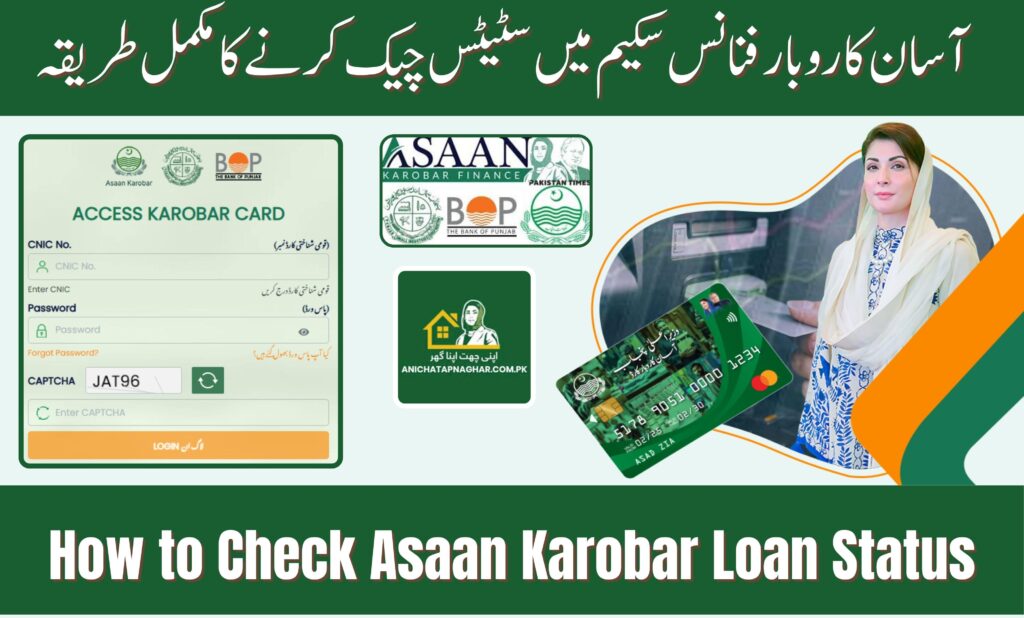

The primary and most reliable method to check your loan status is through the official government portal. You can check the status of your application by logging in to your Asaan Karobar Finance Scheme portal using your login details.

Once you’ve checked the status of your application, you may also need to upload documents or manage your account. For that, simply Login to Asaan Karobar Finance Portal using your registered details.

Portal Access Options:

For Asaan Karobar Finance (AKF):

- Primary URL: akf.punjab.gov.pk

- Alternative access through punjab.gov.pk/asaan-karobar-finance

- Mobile-responsive design for smartphone users

For Asaan Karobar Card (AKC):

- Main portal: akc.punjab.gov.pk

- Dedicated mobile application (available on official app stores)

- SMS-based status updates

Login Requirements: • Your registered CNIC number (13 digits without dashes) • Password created during registration • Registered mobile number for OTP verification • Application reference number for quick access

Dashboard Features After Login:

- Real-time application status updates

- Document upload section for additional requirements

- Communication center for official correspondence

- Loan disbursement details (for approved applications)

- Repayment schedule and tracking

Via SMS Service (if available)

The Punjab government has introduced SMS-based status checking for users who prefer quick updates without portal access:

SMS Status Check Process:

- Send SMS to designated short code: 8484

- Format: AKF [SPACE] [Your CNIC Number]

- Example: AKF 3520212345678

- Receive instant status update on registered mobile number

SMS Response Codes:

- “PENDING” – Application under review

- “APPROVED” – Loan sanctioned, awaiting disbursement

- “REJECTED” – Application declined with reason code

- “DISBURSED” – Funds released to your account

Bank Branch Visit

For entrepreneurs who prefer face-to-face interaction or need detailed clarification, visiting the assigned Bank of Punjab branch remains an effective option:

Branch Visit Benefits:

- Personal consultation with loan officers

- Immediate clarification of status details

- Assistance with documentation issues

- Physical copies of important documents

- Direct submission of additional paperwork

Required Items for Branch Visit:

• Original CNIC and photocopy

• Application acknowledgment receipt

• Mobile phone for verification

• Any correspondence received from the bank

How Can I Check if My Loan is Approved?

Status Messages Explained (Pending, Approved, Rejected)

Understanding the various status indicators helps you interpret your application’s current position in the approval process:

| Status | Description | Expected Timeline | Next Steps |

| Submitted | Application received and under initial review | 3-5 working days | Wait for document verification |

| Under Review | Documents being verified by bank officials | 7-14 working days | Ensure mobile is accessible for queries |

| Pending Verification | Physical verification scheduled or in progress | 10-21 working days | Cooperate with verification team |

| Approved | Loan sanctioned, awaiting disbursement | 3-7 working days | Prepare for fund receipt |

| Rejected | Application declined with specified reasons | Immediate | Review reasons and consider reapplication |

| Disbursed | Funds transferred to your account | N/A | Begin business operations |

Timeline for Approval

Based on current processing patterns, the scheme offers a grace period of up to 6 months for start-ups, indicating the government’s understanding of business development timelines.

Standard Processing Timeline:

Week 1-2: Initial application review and document verification Week 3-4: Credit history checking and eligibility assessment Week 5-6: Physical business verification (if required) Week 7-8: Final approval and disbursement preparation

Factors Affecting Timeline: • Completeness of submitted documentation • Business type and complexity of operations • Bank’s current application volume • Seasonal processing variations • Required verification procedures

Physical Verification Process

Urban Unit conducts physical verification of business premises within 6 months of loan approval and annually thereafter. This process ensures loan funds are utilized for legitimate business purposes and maintains scheme integrity.

Verification Components:

- Business premise inspection

- Equipment and inventory assessment

- Staff verification and business activity confirmation

- Compliance with stated business plan

- Documentation of actual business operations

What to Do If Your Loan is Delayed?

Contact Helpline

When facing application delays, contact the toll-free helpline number at 1786 for immediate assistance and status clarification.

Helpline Services:

- Real-time status updates

- Clarification of pending requirements

- Guidance on document submission

- Escalation of urgent cases

- Technical support for portal issues

Best Times to Call:

- Morning hours (9 AM – 11 AM) for shorter wait times

- Avoid lunch hours (12 PM – 2 PM) when lines are busiest

- Late afternoon (4 PM – 6 PM) for detailed discussions

Resubmit Documents

Common reasons for delays often involve documentation issues that can be quickly resolved:

Document Resubmission Checklist:

• Ensure all documents are clearly scanned or photographed

• Verify CNIC validity and expiration dates

• Update bank statements to recent months

• Provide additional business documentation if requested

• Submit missing certificates or licenses

Quality Requirements:

- High-resolution document scans (minimum 300 DPI)

- Clear visibility of all text and official stamps

- Color documents where specified

- Proper file formats (PDF, JPG, PNG)

- File size within portal limits

Visit Assigned Bank

When portal-based solutions don’t resolve delays, visiting your assigned Bank of Punjab branch provides direct access to loan processing officers:

Branch Visit Preparation:

- Call ahead to schedule appointment

- Prepare all original documents

- Bring printed application acknowledgment

- Note specific queries or concerns

- Allow sufficient time for detailed discussion

Bank Officer Assistance:

- Status explanation with specific details

- Identification of missing requirements

- Expedited processing for urgent cases

- Direct communication with approval committee

- Alternative solution suggestions

Advanced Status Checking Tips

Understanding Application Codes

Each application receives unique identifiers that help track progress through various approval stages:

Reference Number Format:

- AKF applications: AKF-2025-XXXXX

- AKC applications: AKC-2025-XXXXX

- Combined applications: AK-2025-XXXXX

Mobile App Features

The official mobile application provides enhanced tracking capabilities:

App-Exclusive Features:

- Push notifications for status changes

- Document camera for quick uploads

- Offline status viewing

- One-touch helpline calling

- Biometric login options

Email Notifications

Automated email updates keep you informed of significant application milestones:

Email Alert Types:

- Application received confirmation

- Document verification completion

- Approval notification with next steps

- Disbursement confirmation

- Monthly account statements (post-approval)

Troubleshooting Common Issues

Portal Access Problems

Common Solutions:

- Clear browser cache and cookies

- Try different browsers (Chrome, Firefox, Safari)

- Check internet connection stability

- Disable ad-blockers temporarily

- Use incognito/private browsing mode

Status Display Errors

Sometimes the portal may show outdated or incorrect status information:

Resolution Steps:

- Refresh the page and wait 5 minutes

- Log out completely and log back in

- Check during off-peak hours

- Contact technical support if issues persist

- Use alternative checking methods temporarily

Conclusion

Learning how to check Asaan Karobar loan status effectively empowers you to stay informed throughout your financing journey with Punjab’s groundbreaking interest-free loan scheme. Whether you prefer the comprehensive portal dashboard, convenient SMS updates, or personal bank visits, multiple checking methods ensure you’re never left wondering about your application progress.

By understanding status indicators, approval timelines, and troubleshooting common issues, you can confidently navigate the system while focusing on preparing your business for success. Remember to utilize the helpline support at 1786 whenever needed, and maintain regular status checks to stay updated on your path toward securing interest-free financing for your entrepreneurial dreams.

Frequently Asked Questions (FAQs)

1. How long does it typically take for loan approval in the Asaan Karobar scheme?

The standard approval timeline ranges from 4-8 weeks depending on documentation completeness and verification requirements.

2. Can I check my Asaan Karobar loan status without internet access?

Yes, you can use the SMS service by texting AKF followed by your CNIC to 8484 for instant status updates.

3. What should I do if my application status shows ‘rejected’?

Review the rejection reasons provided, address the issues mentioned, and reapply after correcting the problems identified.

4. Is there a mobile app to check Asaan Karobar loan status?

Yes, the official Punjab government mobile app includes loan status checking features for all government schemes.

5. How often is the loan status updated in the portal?

Status updates occur in real-time as your application moves through different approval stages and verification processes.

1 thought on “How to Check Asaan Karobar Loan Status Complete Guide 2025”