Imagine starting or expanding your business without the burden of high interest rates eating into your profits. For entrepreneurs across Punjab, this dream has become a reality through the Asaan Karobar Finance Scheme 2025. This revolutionary initiative by Chief Minister Maryam Nawaz represents a paradigm shift in how Pakistan supports its small and medium enterprises (SMEs).

Whether you’re a young graduate with a business idea or an experienced entrepreneur looking to modernize your operations, this comprehensive guide will walk you through everything you need to know about the Asaan Karobar Finance Scheme 2025. From application processes to eligibility criteria, we’ll cover all aspects to help you secure funding for your entrepreneurial journey.

Table of Contents

What is the Asaan Karobar Finance Scheme?

Background of CM Punjab Asaan Karobar Finance Scheme 2025

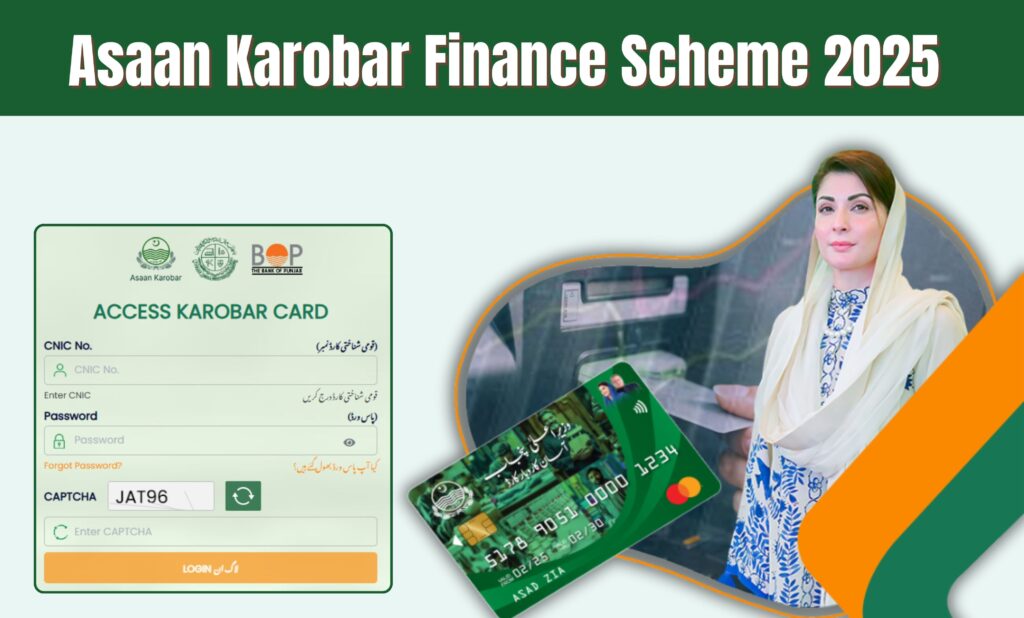

The CM Punjab Asaan Karobar Finance Scheme 2025 is a groundbreaking financial initiative launched by the Punjab government to stimulate economic growth and support entrepreneurship across the province. This scheme represents the government’s commitment to creating a business-friendly environment where entrepreneurs can thrive without the traditional barriers of high-interest loans and complex approval processes.

Asaan Karobar Card Scheme – What It Is & How It Works

The scheme operates through two distinct financing options:

1. Asaan Karobar Finance (AKF):

- Provides interest-free loans ranging from PKR 1 million to PKR 30 million

- Designed for established businesses looking to expand or modernize

- Managed through Bank of Punjab with government backing

2. Asaan Karobar Card (AKC):

- Offers digital SME cards with credit limits up to PKR 1 million

- Perfect for micro and small entrepreneurs

- Features transparent fund utilization through digital channels

The innovative approach eliminates traditional banking complexities by providing a streamlined digital platform where entrepreneurs can access funds quickly and efficiently.

Benefits of the Scheme for Small Businesses

The Asaan Karobar Finance Scheme details reveal numerous advantages for small business owners:

• Zero Interest Rate: Complete elimination of interest charges, making it truly affordable for entrepreneurs

• Flexible Loan Amounts: From PKR 1 million for small ventures to PKR 30 million for larger enterprises

• Digital Integration: Modern, app-based management system for transparent fund tracking

• Government Support: Backing from Punjab government ensures credibility and sustainability

• Quick Processing: Streamlined approval process without unnecessary bureaucratic delays

• Sector Diversity: Support for multiple industries including agriculture, manufacturing, and services

Asaan Karobar Finance Scheme 2025 Online Apply

Step-by-Step Process for Online Application

The online application process for the Asaan Karobar Finance Scheme 2025 has been designed with user convenience in mind. Here’s your complete roadmap:

Step 1: Registration

- Visit the official Punjab government portal

- Create your account using a valid CNIC and mobile number

- Verify your identity through OTP confirmation

Step 2: Profile Setup

- Complete your personal information

- Add business details, including sector and location

- Upload required documentation

Step 3: Loan Application

- Select appropriate loan category (AKF or AKC)

- Specify the loan amount based on your business needs

- Submit business plan and feasibility study

Step 4: Review and Submission

- Double-check all information for accuracy

- Apply for government review

- Receive an acknowledgment receipt with tracking number

Official Portal Link for Registration

The primary registration portal for the scheme is managed through the Punjab Information Technology Board (PITB). Applicants should access the official website at punjab.gov.pk for authentic applications. Always ensure you’re using official government websites to avoid fraudulent portals.

Required Documents for Application

Essential documentation for the Asaan Karobar Finance Scheme 2025, how to apply Pakistan includes:

• Valid CNIC (original and photocopy)

• Bank statements for the last 6 months

• Business registration documents

• Tax filing certificates (FBR registration)

• Business plan with financial projections

• Utility bills for business address verification

• Guarantor documentation (if required)

• Educational certificates

• Experience certificates (for relevant sectors)

Asaan Karobar Finance Scheme 2025 Last Date

Currently, the government has not announced a specific deadline for applications. The Asaan Karobar Finance Scheme 2025 last date remains open-ended, indicating the program’s ongoing nature. However, given the popularity and limited budget allocation, early application is strongly recommended to ensure consideration.

Eligibility Criteria for Asaan Karobar Finance Scheme

Who Can Apply for the Scheme?

The Asaan Karobar Finance Scheme eligibility criteria are designed to be inclusive while ensuring responsible lending:

Primary Requirements:

- Pakistani citizenship with valid CNIC

- Permanent residence in Punjab province

- Business operations located within Punjab boundaries

- Active FBR tax filer status

- Clean credit history with no defaults

Minimum and Maximum Loan Limits

| Scheme Type | Minimum Amount | Maximum Amount | Target Audience |

| Asaan Karobar Card | PKR 50,000 | PKR 1 Million | Micro/Small Entrepreneurs |

| Asaan Karobar Finance | PKR 1 Million | PKR 30 Million | SMEs & Established Businesses |

Age, Income, and Business Type Requirements

Age Criteria:

- Applicants must be between 25-55 years for AKF

- Age range of 21-57 years for AKC applications

Business Categories:

- Small enterprises with annual sales up to PKR 150 million

- Medium enterprises with sales between PKR 150-800 million

- Manufacturing, agriculture, services, and technology sectors

- Both new startups and existing businesses eligible

Income Requirements:

- Demonstrable business income or viable business plan

- Financial capacity to repay loan installments

- Collateral or guarantor requirements vary by loan amount

Who is Eligible for CM Punjab Karobar Finance Scheme?

Who is eligible for CM Punjab Karobar Finance Scheme? The scheme welcomes Pakistani citizens aged 25-55 years, residing in Punjab, with registered businesses or viable startup plans, clean credit history, and active tax filing status. Both new entrepreneurs and existing business owners can apply based on their financial needs and business objectives.

Benefits of Asaan Karobar Finance Scheme 2025

Low-Interest or Interest-Free Loans

The most significant advantage of this initiative is the complete elimination of interest charges. Traditional business loans in Pakistan typically carry interest rates between 15-25% annually, creating substantial financial pressure on entrepreneurs. The Asaan Karobar Finance Scheme 2025 removes this burden entirely, allowing business owners to focus their resources on growth rather than debt servicing.

Support for Small and Medium Businesses

The scheme addresses the critical financing gap that has historically limited SME growth in Pakistan. By providing accessible credit without collateral requirements for smaller amounts, the program democratizes business financing. This approach particularly benefits:

• Women entrepreneurs entering the business sector • Young graduates with innovative business ideas • Rural entrepreneurs lacking traditional banking relationships • Existing businesses seeking modernization and expansion • Technology startups requiring initial capital investment

Government’s Role in Promoting Entrepreneurship

The Punjab government’s involvement extends beyond mere financing. The comprehensive support system includes:

Business Development Services:

- Pre-approved business plans and feasibility studies

- Technical assistance for loan recipients

- Training programs for business management

- Market linkage support for product promotion

Institutional Support:

- Partnership with Bank of Punjab for implementation

- Integration with existing government schemes

- Monitoring and evaluation systems for success tracking

- Policy framework supporting business-friendly regulations

Key Features and Implementation Details

Digital Innovation in Finance

The scheme leverages modern technology to ensure transparency and efficiency. The Asaan Karobar Card functions as a digital financial instrument, allowing real-time tracking of fund utilization through mobile applications and point-of-sale systems. This technological integration ensures accountability while providing entrepreneurs with convenient access to their approved credit lines.

Sector-Specific Opportunities

The program prioritizes key economic sectors that drive Punjab’s growth:

Agriculture and Agribusiness:

- Support for modern farming equipment

- Food processing and value addition

- Cold storage and supply chain development

Manufacturing:

- Small-scale industrial units

- Textile and garment production

- Handicrafts and traditional industries

Services Sector:

- Information technology and software development

- Healthcare and education services

- Transportation and logistics

Repayment Structure

The flexible repayment mechanism accommodates different business cycles and cash flow patterns. Entrepreneurs can choose from various repayment schedules based on their business type and revenue generation patterns. The absence of interest charges significantly reduces the total repayment burden, making the scheme genuinely affordable for small business owners.

Success Stories and Impact

Since its launch, the Asaan Karobar Finance Scheme 2025 has already begun transforming lives across Punjab. Early beneficiaries report increased confidence in business expansion, job creation within their communities, and improved financial stability. The scheme’s impact extends beyond individual businesses to contribute to overall economic development and employment generation in the province.

Application Tips for Success

To maximize your chances of approval, consider these practical strategies:

Prepare a Comprehensive Business Plan:

- Clearly define your business objectives and target market

- Include realistic financial projections and timeline

- Demonstrate understanding of your industry and competition

Maintain Clean Financial Records:

- Ensure all tax filings are up-to-date

- Keep detailed records of existing business operations

- Clear any outstanding credit issues before applying

Choose the Right Loan Category:

- Assess your actual funding requirements carefully

- Consider your repayment capacity realistically

- Match your business size with appropriate scheme type

Conclusion

The Asaan Karobar Finance Scheme 2025 represents a transformative opportunity for entrepreneurs across Punjab to access interest-free financing for their business ventures. With its comprehensive support system, digital innovation, and government backing, this initiative addresses the fundamental challenges that have historically limited SME growth in Pakistan.

By eliminating interest charges and streamlining the application process, the scheme democratizes access to business capital, enabling entrepreneurs to focus on growth and innovation rather than debt management. Whether you’re launching a startup or expanding an existing business, the Asaan Karobar Finance Scheme 2025 provides the financial foundation needed to turn your entrepreneurial dreams into reality while contributing to Punjab’s economic development and job creation goals.

Frequently Asked Questions (FAQs)

1. What is the maximum loan amount available under the Asaan Karobar Finance Scheme 2025?

The scheme offers up to PKR 30 million through the Asaan Karobar Finance component and up to PKR 1 million through the Asaan Karobar Card.

2. Is there any interest charged on loans under this scheme?

No, the Asaan Karobar Finance Scheme 2025 provides completely interest-free loans to all approved applicants.

3. Can businesses outside Punjab apply for this scheme?

No, both the applicant’s residence and business operations must be located within Punjab province to be eligible.

4. What is the minimum age requirement for applying?

Applicants must be between 25-55 years old for the main finance scheme and 21-57 years for the card scheme.

5. How long does the application process typically take?

The processing time varies, but most applications are reviewed within 4-6 weeks of submission with all required documentation.

3 thoughts on “Asaan Karobar Finance Scheme 2025 Fast Free Business Loans”